How To Find The Right Investment Account That Fits Your Needs

Understanding Investment Accounts

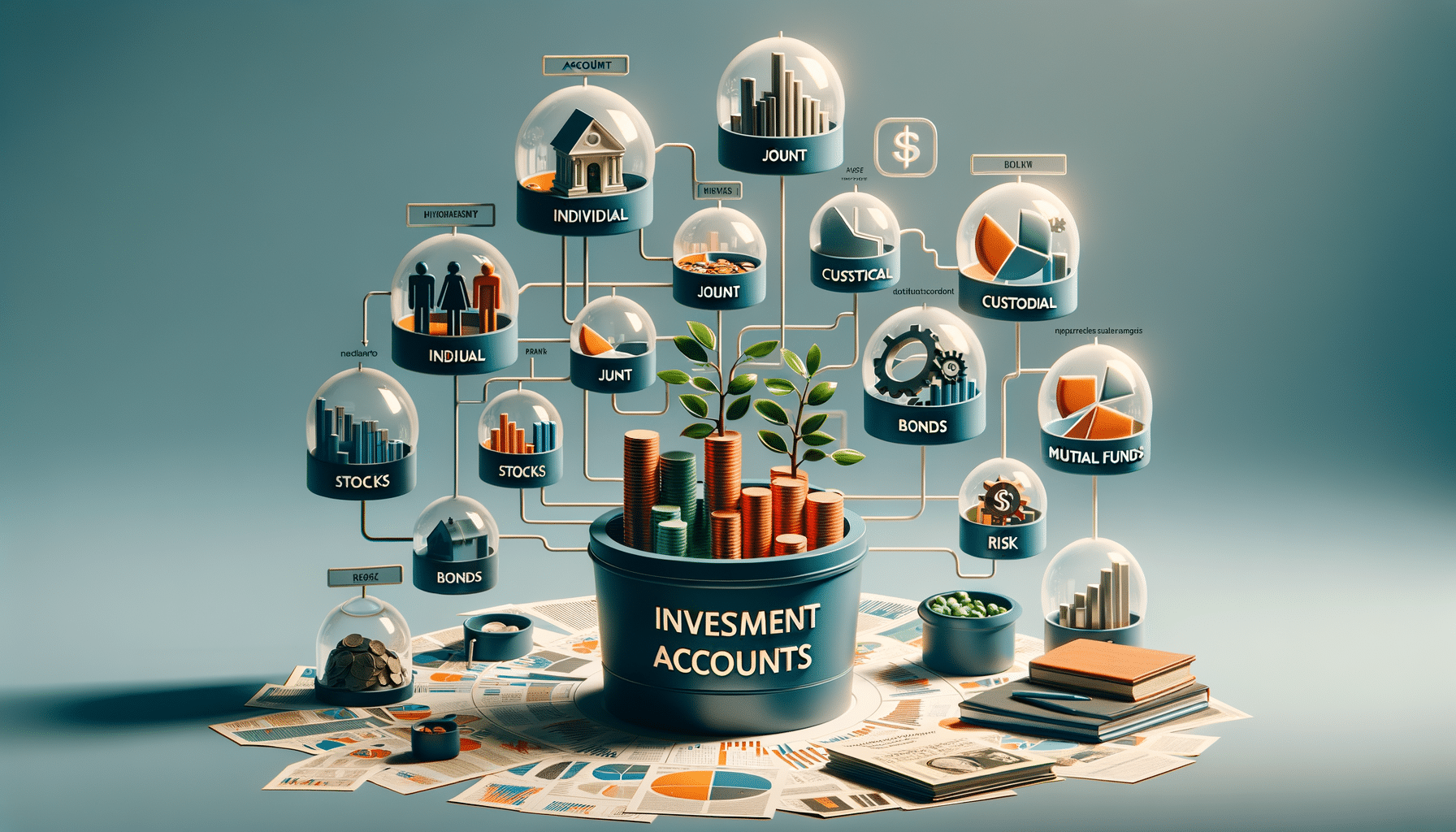

Investment accounts are essential tools for anyone looking to grow their wealth over time. These accounts provide a platform for buying, holding, and selling various types of investments, including stocks, bonds, mutual funds, and more. Understanding the different types of investment accounts and their features can help you make informed decisions about which one aligns with your financial goals.

There are several types of investment accounts, each serving different purposes. Common types include brokerage accounts, retirement accounts, and education savings accounts. Each type of account has its own set of rules, tax implications, and benefits. For instance, brokerage accounts offer flexibility and liquidity, making them suitable for short-term goals. On the other hand, retirement accounts like IRAs and 401(k)s provide tax advantages, making them ideal for long-term savings.

Choosing the right investment account depends on your financial objectives, risk tolerance, and investment horizon. By understanding the characteristics of each account type, you can better align your investment strategy with your overall financial plan.

Types of Investment Accounts

Investment accounts come in various forms, each designed to meet specific financial needs and goals. Here’s a closer look at some of the most common types:

- Brokerage Accounts: These accounts allow you to buy and sell a wide range of investments. They offer flexibility and easy access to your funds, making them suitable for both short-term and long-term investment strategies.

- Retirement Accounts: Accounts like IRAs and 401(k)s provide tax advantages to encourage long-term savings. Contributions may be tax-deductible, and earnings can grow tax-deferred or tax-free, depending on the account type.

- Education Savings Accounts: Designed to help save for education expenses, accounts like 529 plans offer tax benefits and can be a strategic way to fund future educational needs.

Each type of account has its own set of rules and benefits. For instance, retirement accounts often have contribution limits and early withdrawal penalties, while brokerage accounts offer more flexibility but come with capital gains taxes. Understanding these differences is crucial in selecting the right account for your needs.

Factors to Consider When Choosing an Investment Account

Choosing the right investment account involves considering several factors that align with your financial goals and circumstances. Here are some key considerations:

- Investment Goals: Are you saving for retirement, a major purchase, or education? Your goals will determine the type of account that best suits your needs.

- Tax Considerations: Different accounts offer various tax advantages. Understanding these can help you maximize your savings and minimize tax liabilities.

- Risk Tolerance: Your comfort level with risk will influence the types of investments you choose within your account. Some accounts offer more conservative options, while others provide access to higher-risk investments.

- Time Horizon: The length of time you plan to invest will affect your account choice. Long-term goals may benefit from tax-advantaged accounts, while short-term objectives might require more flexible options.

By carefully evaluating these factors, you can select an investment account that aligns with your financial strategy and helps you achieve your objectives.

Benefits of Diversifying Investment Accounts

Diversification is a key principle in investing, and it extends to the types of accounts you hold. By spreading your investments across different accounts, you can enjoy several benefits:

- Risk Management: Diversifying across accounts can help mitigate risks associated with market volatility and economic changes.

- Tax Efficiency: Utilizing various accounts can optimize tax benefits. For instance, holding certain investments in tax-advantaged accounts can reduce tax liabilities.

- Goal Alignment: Different accounts can be tailored to specific financial goals, allowing for a more structured and effective investment strategy.

By leveraging the unique features of different investment accounts, you can create a robust and resilient portfolio that supports your long-term financial success.

Steps to Open an Investment Account

Opening an investment account is a straightforward process, but it requires careful planning and consideration. Here are the steps to guide you:

- Determine Your Goals: Identify what you want to achieve with your investments. Whether it’s retirement savings or funding a child’s education, having clear goals will guide your account selection.

- Research Account Types: Explore the various investment accounts available and their features. Consider the tax implications, fees, and investment options each account offers.

- Choose a Financial Institution: Select a reputable institution that offers the account type you need. Consider factors such as customer service, online tools, and educational resources.

- Complete the Application: Gather the necessary documentation, such as identification and financial information, and fill out the application form. Many institutions offer online applications for convenience.

- Fund Your Account: Once your account is open, deposit funds to start investing. You can set up automatic contributions to build your investments over time.

By following these steps, you can open an investment account that aligns with your financial goals and sets the foundation for future growth.