How To Find The Right Investment Account That Fits Your Needs

Understanding Investment Accounts

Investment accounts are essential tools for individuals looking to grow their wealth over time. These financial accounts allow individuals to buy, hold, and sell a variety of investments, such as stocks, bonds, and mutual funds. By diversifying their portfolio, investors can potentially increase their returns while managing risk. The importance of investment accounts lies in their ability to facilitate long-term financial growth, offering a pathway to achieving personal financial goals, such as retirement savings, purchasing a home, or funding education.

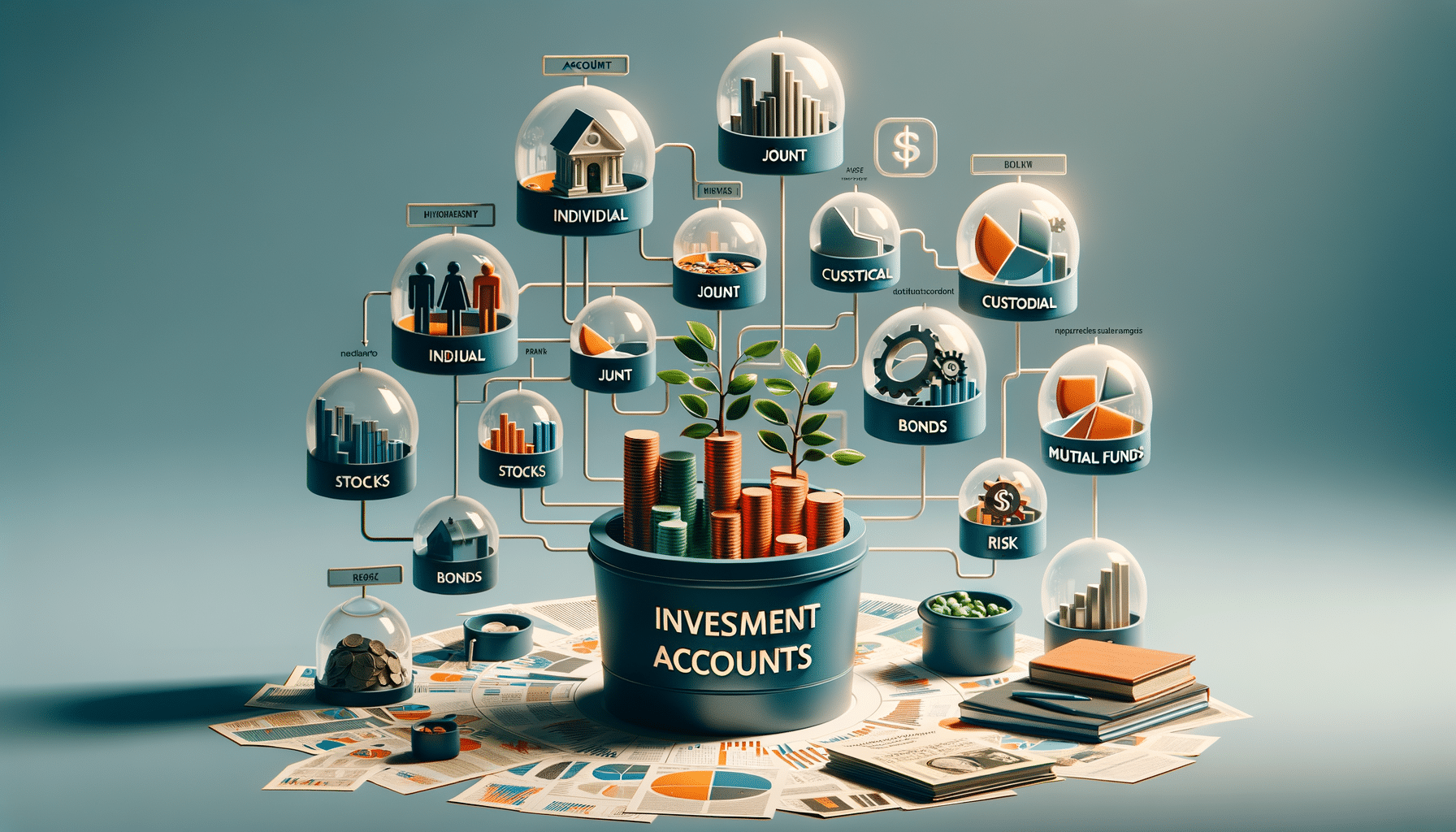

There are several types of investment accounts, each tailored to different investor needs and financial goals. Common types include brokerage accounts, retirement accounts like IRAs and 401(k)s, and education savings accounts. These accounts differ in terms of tax benefits, contribution limits, and withdrawal rules, making it crucial for investors to understand their unique features before making a decision.

Types of Investment Accounts

When choosing an investment account, it’s important to consider the various options available. Each type of account offers different benefits and is suited to particular financial objectives. Here are some of the most common types of investment accounts:

- Brokerage Accounts: These accounts offer flexibility and accessibility, allowing investors to buy and sell a wide range of securities. They are suitable for those who want to actively manage their investments.

- Retirement Accounts: Accounts like IRAs and 401(k)s provide tax advantages to encourage long-term savings for retirement. Contributions to these accounts may be tax-deductible, and earnings can grow tax-deferred or tax-free, depending on the account type.

- Education Savings Accounts: Accounts such as 529 plans are designed to help families save for future education expenses. They offer tax benefits and can be used for qualified education costs.

Choosing the right type of investment account depends on an individual’s financial goals, investment strategy, and tax considerations. Understanding the features and benefits of each account type is crucial for making informed decisions.

Tax Implications of Investment Accounts

Tax considerations are a critical aspect of selecting an investment account. Different accounts come with varying tax implications that can significantly impact an investor’s net returns. Here’s a closer look at how taxes affect investment accounts:

- Taxable Accounts: Brokerage accounts are typically taxable, meaning investors must pay taxes on dividends, interest, and capital gains. However, they offer flexibility with no contribution limits or withdrawal restrictions.

- Tax-Deferred Accounts: Retirement accounts like traditional IRAs and 401(k)s allow contributions to grow tax-deferred until withdrawal. This can be advantageous for individuals in high tax brackets during their working years.

- Tax-Free Accounts: Roth IRAs and certain education savings accounts offer tax-free growth and withdrawals, provided certain conditions are met. These accounts are ideal for those who anticipate being in a higher tax bracket in retirement.

Understanding the tax implications of each account type is essential for maximizing investment returns and minimizing tax liabilities. Investors should consider consulting with a financial advisor to navigate complex tax rules and optimize their investment strategy.

Choosing the Right Investment Account

Selecting the appropriate investment account requires careful consideration of various factors, including financial goals, risk tolerance, and investment horizon. Here are some key steps to finding the right account:

- Define Financial Goals: Identify specific financial objectives, such as retirement savings, education funding, or wealth accumulation. This will help determine the most suitable account type.

- Assess Risk Tolerance: Evaluate your comfort level with investment risk. Accounts with higher potential returns often come with increased risk, so it’s important to align your risk tolerance with your investment strategy.

- Consider Time Horizon: Determine the length of time you plan to invest. Long-term goals may benefit from accounts with tax advantages, while short-term goals may require more liquid options.

By carefully evaluating these factors and understanding the features of different investment accounts, individuals can make informed decisions that align with their financial aspirations.

Managing and Monitoring Investment Accounts

Once an investment account is opened, ongoing management and monitoring are essential to ensure it continues to meet financial goals. Here are some best practices for managing investment accounts effectively:

- Regularly Review Portfolio: Periodically assess the performance of your investments and make adjustments as needed to maintain alignment with your financial goals and risk tolerance.

- Stay Informed: Keep up-to-date with market trends and economic developments that could impact your investments. Staying informed allows for proactive decision-making.

- Utilize Professional Guidance: Consider consulting with a financial advisor to gain insights and expertise in managing your investment account. Advisors can provide personalized advice tailored to your financial situation.

Effective management and monitoring of investment accounts are crucial for achieving long-term financial success. By staying engaged and informed, investors can navigate the complexities of the financial markets and optimize their investment strategy.