How To Take Advantage of Online Banking

Introduction to Online Banking

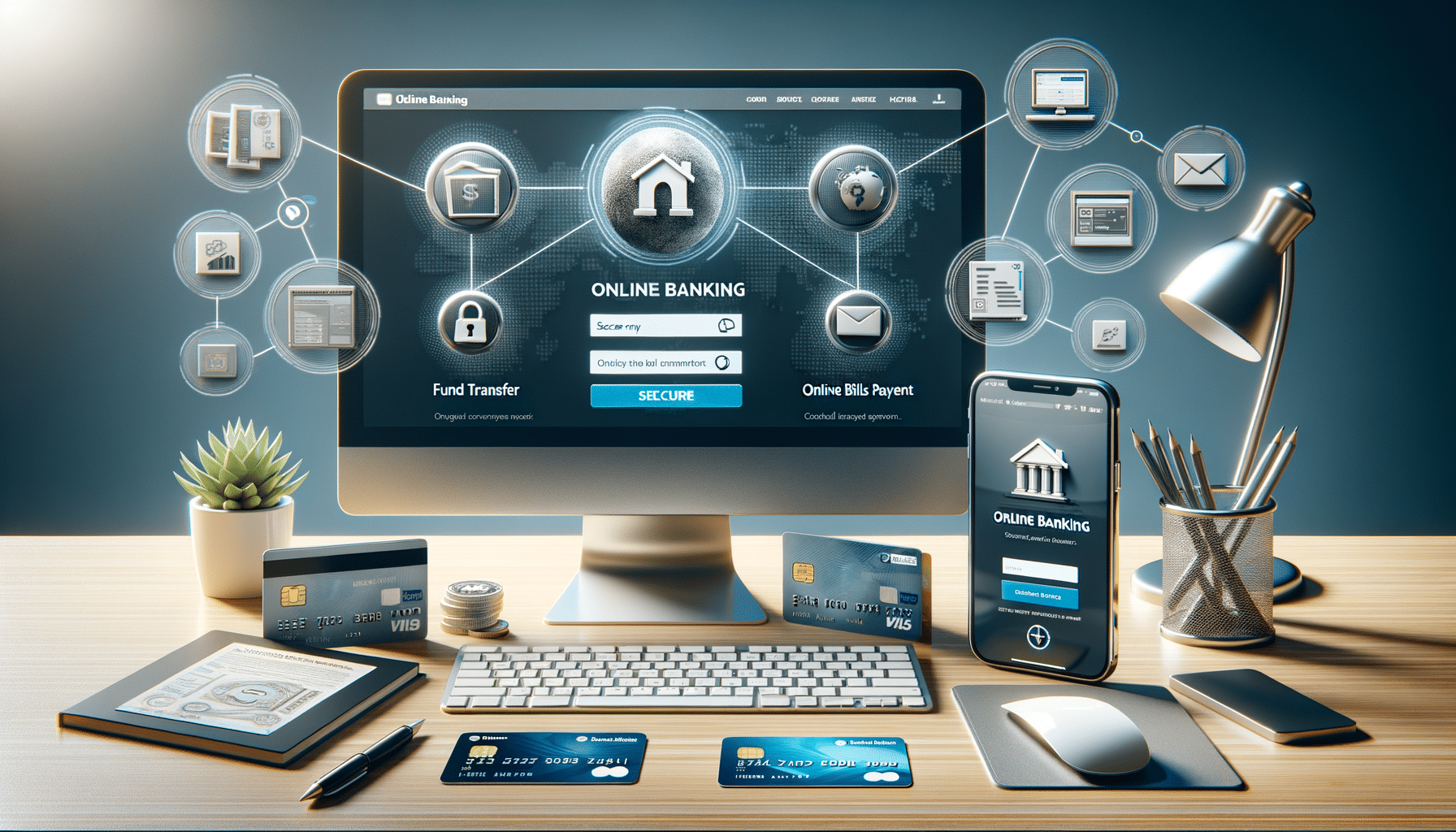

In today’s fast-paced digital world, online banking has become an indispensable tool for managing personal finances. Offering the convenience of accessing your bank account anytime and anywhere, it provides users the ability to monitor their account balances, transfer funds, and pay bills without stepping into a bank branch. This digital transformation of banking services aligns with the modern consumer’s need for efficiency and accessibility.

Online banking is not just a trend; it’s a significant shift in how financial services are delivered and consumed. It empowers users by providing a comprehensive suite of services that were once only available in person. As more people embrace this technology, understanding how to effectively utilize online banking can lead to better financial management and planning.

Features and Benefits of Online Banking

Online banking platforms offer a wide array of features designed to enhance user experience and financial management. Some of the most notable features include:

- Account Monitoring: Users can check their account balances and transaction history in real-time, helping them stay informed about their financial status.

- Fund Transfers: Transferring money between accounts or to other individuals has never been easier, with options for domestic and international transfers.

- Bill Payments: Many online banking platforms allow users to set up automatic bill payments, reducing the risk of late fees and missed payments.

- Mobile Banking Apps: With dedicated mobile apps, users can perform banking tasks on the go, further enhancing convenience.

These features not only simplify financial tasks but also provide a level of control and security that traditional banking methods may lack. By leveraging these tools, users can manage their finances more effectively and make informed financial decisions.

Security Measures in Online Banking

Security is a top priority for online banking platforms, as they handle sensitive financial information. To protect users, banks implement a variety of security measures, such as:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to verify their identity through a second method, such as a text message or authentication app.

- Encryption: Data transmitted between the user’s device and the bank’s servers is encrypted, making it difficult for unauthorized parties to access sensitive information.

- Fraud Detection Systems: Advanced algorithms monitor account activity for unusual transactions, alerting users to potential fraudulent activity.

While these measures significantly reduce the risk of cyber threats, users must also practice safe online habits, such as using strong passwords and keeping their software updated, to ensure their online banking experience remains secure.

Challenges and Considerations

Despite its many advantages, online banking is not without its challenges. Users may encounter issues such as:

- Technical Difficulties: System outages or connectivity issues can temporarily hinder access to online banking services.

- Learning Curve: New users may need time to familiarize themselves with the platform’s features and navigation.

- Security Concerns: While banks implement robust security measures, the risk of phishing scams and cyber attacks remains a concern.

To mitigate these challenges, users should stay informed about the latest security practices and utilize customer support resources provided by their banks. By doing so, they can maximize the benefits of online banking while minimizing potential drawbacks.

The Future of Online Banking

As technology continues to evolve, so too will online banking. Innovations such as artificial intelligence and blockchain technology are poised to further enhance the online banking experience by offering personalized financial advice and more secure transactions. The integration of these technologies promises to make online banking even more user-friendly and secure.

Looking ahead, we can expect online banking to become even more integrated into our daily lives, with seamless connectivity across various devices and platforms. As consumer expectations grow, banks will need to continuously adapt and innovate to meet the demands of a tech-savvy clientele.

Ultimately, the future of online banking is bright, with endless possibilities for improving financial management and accessibility. By staying informed and embracing these changes, users can continue to reap the benefits of this ever-evolving financial landscape.